Crypto trading is built on speed, clarity, and precision. Visual cues drive decisions. Every candle speaks. Every spike, dip, and sideways grind carries a message. Traders today look at more than just numbers. They interpret behavior, energy, and momentum, all through the lens of charting tools. In this world, visuals shape trades. Tools translate chaos into patterns. With so much movement, clarity becomes the compass. Traders do not scroll aimlessly. They study price action like a second language. What changed? Technology. Discipline. And access to tools that turn raw market data into strategic moves.

Charting has become the heartbeat of crypto trading. Those who understand it navigate volatility with control. Those who rely on visuals adapt faster. It’s no longer about trying things. It’s about seeing, tracking, reading, and acting. A chart tells the story before the market headlines do. And in crypto, timing changes outcomes. Good visuals bring that timing into focus.

Why Visual Precision Shapes Every Trade?

Every move in crypto reflects pressure. Buyer pressure. Seller pressure. Sentiment that builds and reverses. Without a visual tool, that pressure remains invisible. But with candlesticks, trendlines, and clear indicators, traders monitor live behavior. The chart reflects what the market feels.

A sharp reversal near a previous high? That’s rejection. A rising support holding across sessions? That’s strength. Charts show where participants are stepping in, stepping away, or preparing to shift. Traders rely on this rhythm. Not instincts. Not randomness. But observable, repeatable patterns.

Visual precision makes all the difference. A five-minute lag ruins a setup. A cluttered interface causes missed entries. Tools that prioritize visual speed and clean data presentation allow traders to respond, not overreact. Each candle, volume bar, and overlay shapes the next move. And when tools reveal the full structure, confidence builds naturally.

Reading Markets in Layers

Markets move in waves, not single bursts. Charting tools allow traders to zoom out and zoom in, tracking structure across timeframes. The daily chart shows the broader trend. The hourly chart reveals short-term friction. The 15-minute chart highlights entry opportunities. Each timeframe adds a new dimension. It’s never one or the other. It’s all of them, stitched together.

This layered reading forms the base of advanced trading. A support zone on the daily chart holds more weight. An hourly breakout gains credibility if it aligns with momentum on higher timeframes. Traders build their perspective from the top down, refining timing without sacrificing structure.

Charting tools that offer seamless transitions between views, multiple overlays, and synchronized layout comparison empower traders to operate with awareness. They’re not moving blindly. They’re watching market structure unfold like a map in real time.

Why Overlays and Indicators Deepen Visual Insight?

A raw price chart offers plenty, but indicators sharpen its edge. Moving averages highlight the slope of momentum. Bollinger Bands signal contraction and expansion. RSI shows price energy. Volume bars confirm buyer or seller participation. The interplay between these visuals builds clarity.

Each indicator helps verify or question what the price appears to do. A breakout above resistance without rising volume loses strength. A trendline breach without supporting momentum shows hesitation. Smart traders layer these visuals not to complicate, but to confirm. They focus on the confluence, the moment when multiple signals align to validate a decision.

Traders also customize these overlays. Color-coded setups. Simplified lines. Fewer distractions. Charting tools that let users modify their visual field allow focus to sharpen. Precision becomes easier. Clarity stays intact.

How Clean Charts Accelerate Decision Making

Speed is a trader’s hidden weapon. Not rushed clicks, but quick clarity. Tools that offer clean visuals, responsive zoom, intuitive drawing features, and fast rendering save precious seconds. And in fast-moving markets, those seconds impact execution.

Traders mark support zones. Draw Fibonacci levels. Identify breakouts. They do this using drawing tools that snap into position and hold steady. They review setups on multiple screens or devices, expecting the same accuracy everywhere. Platforms that deliver this consistency across the board win trust.

Beyond technical features, visual clarity reduces hesitation. When traders trust what they see, they act with conviction. No double-checking, no misreading. Just structured moves. Platforms that strip away clutter allow the brain to prioritize pattern over panic.

When the Screen Becomes Your Edge

Most traders think they need better strategies. But as per a lot of experts, what they often need first is a better screen. Not more tabs. Not more tokens. Just one clean interface that reflects what the market’s doing, without friction, without noise.

Experts say you don’t need to watch everything. You need to watch the right things. Real-time structure. Momentum shifts. Volume confirmation. Entry and exit zones that don’t hide behind overlays or lagging feeds.

That’s where your edge lives: in visibility. In seeing it clearly before others do. In reacting milliseconds faster because your chart didn’t glitch or guess.

Great traders aren’t born with instinct. They develop it. Repetition. Familiarity. Speed. It’s a rhythm and the chart is the instrument. Visiion.io, paired with TradinView, gives you tempo.

If you can see it faster, cleaner, and sharper, you’re already ahead.

Visiion.io Approach to Seamless Charting

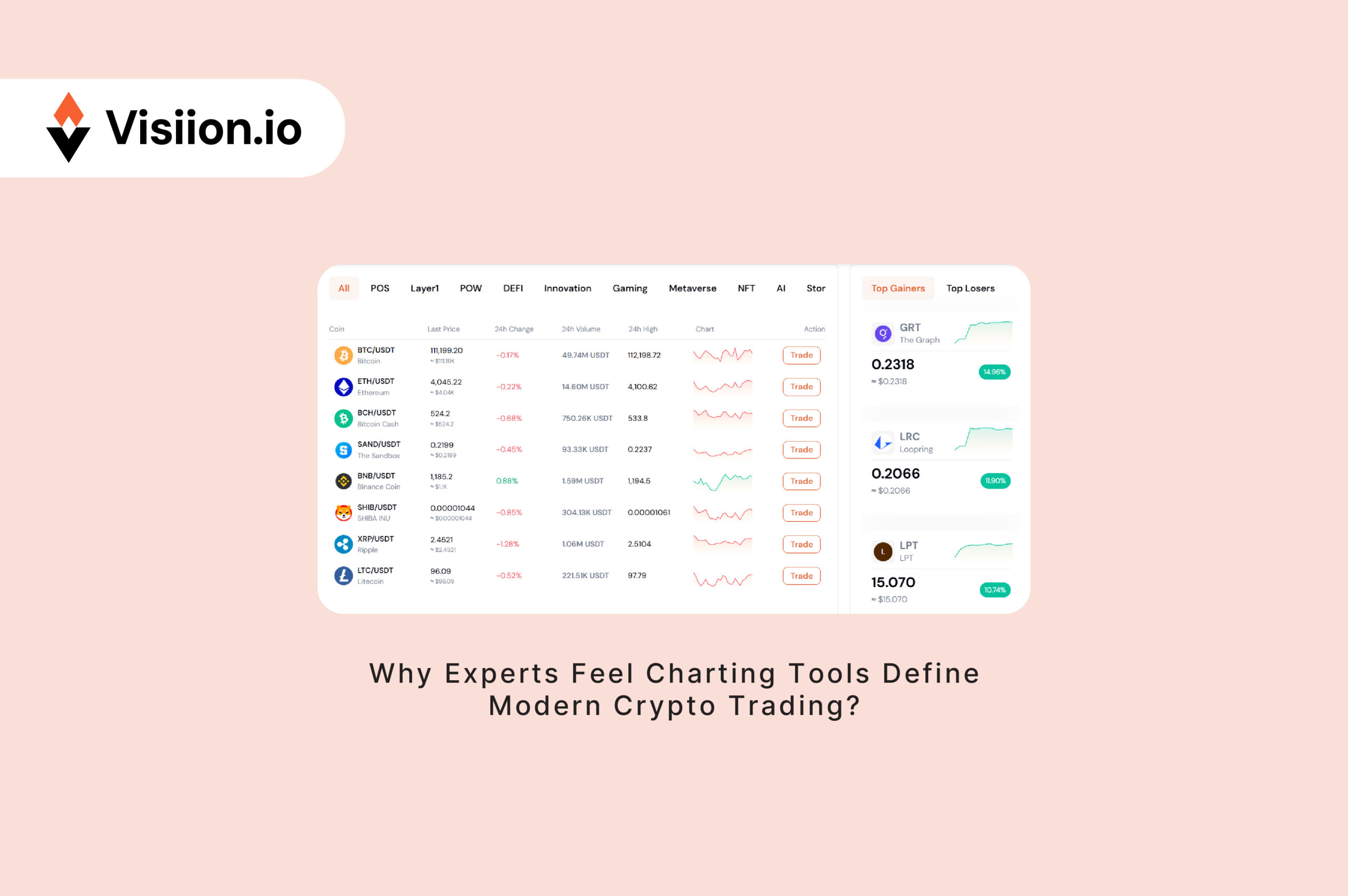

At Visiion.io, clarity is not a feature. It’s the core experience. Every chart loads instantly. Every movement tracks in real time. Users adjust timeframes, place indicators, draw on live data, without friction. No lag. No second-guessing. Just precision.

We’ve embedded TradingView’s charting engine directly into our platform. That means traders operate with the same professional-grade infrastructure trusted across global markets. Technical analysis becomes natural. Custom layouts, color schemes, and interactive setups make each trader’s experience personal, yet powerful.

Whether analyzing short-term breakouts or long-term accumulation ranges, Visiion.io delivers tools that feel intuitive and fast. Users create alerts, save patterns, set zones, all with precision. And the screen stays clean. No crowding. Just structure.

Exceptional Utility

New traders need simplicity. Pro traders need customization. Visiion.io supports both. Beginners explore clear charts with guided visuals. Experts dive into layered analysis, multi-screen setups, and indicator combinations.

Every action on the platform is built for speed and structure. Real-time updates. Watchlist integration. Easy symbol switching. Full-screen focus. It’s a workspace, not a maze.

This balance between depth and simplicity makes Visiion.io adaptable. It removes friction without diluting functionality. It respects the need for speed, but never at the cost of control.

How Traders Track Momentum Visually?

Momentum is visible when someone looks at the charts. A long green candle with strong volume near resistance? Could be a momentum. A fast pullback that catches no bids? Could be a fading interest. Traders read this momentum through chart visuals, not guesswork.

As per experts, MACD signals trend shifts and RSI shows exhaustion. Volume profiles map accumulation or distribution. Instead of replacing thinking, experts believe such tools enhance it.

Experts say platforms that present this data with accuracy and clarity allow traders to act earlier. A breakout backed by structure becomes tradable. A pullback to support becomes a second entry. When the chart speaks clearly, hesitation fades and traders can better execute their trades.

How Structure Builds Confidence in Every Trade?

Uncertainty slows traders down. Structure speeds them up. When traders identify their zones, place their levels, and track market behavior within these boundaries, confidence builds.

This structure doesn’t come from instincts. It comes from charts. Trendlines show where pressure builds. Rectangles box in consolidation. Fibonacci retracements highlight pullback ranges. Support holds. Resistance caps. Each element plays a role.

And as structure forms, traders prepare. They place alerts. Review historical reactions. Wait for behavior that confirms their plan. Structure allows action. Not reaction.

Execution is the Key

It’s not possible for anyone to memorize charts, not even for experienced traders. They internalize visual behaviors. They remember how breakouts fail near weak volume. They recall how bullish engulfing candles often form after prolonged dips. Their experience comes from repeated observation, all through charts.

Charting tools help traders reinforce this memory. They capture screenshots. Journal trades. Analyze what worked. What didn’t. Each trade teaches. Each setup becomes a case study. The visual pattern becomes the anchor.

Platforms that support this learning process, through notes, shared charts, and replay features, help traders grow. They transform short-term lessons into long-term mastery.

How Platforms Like Visiion.io Shape the Future of Visual Trading?

As markets evolve, charting will evolve too. AI-based pattern detection. Predictive models built on multi-indicator confluence. Real-time alerts that adapt based on volatility. These features are on the horizon.

But the core remains: clear, fast, responsive charts. Platforms like Visiion.io are designed around that principle. We believe that clarity shapes conviction. That every trader, regardless of style, deserves visuals that reveal structure, not hide it.

We are not a charting provider. We are a trading platform built on visual accuracy. Powered by TradingView. Enhanced by our own interface innovations. Focused entirely on the user experience.

Visual Confidence Drives Every Move

In crypto, conditions change fast. A rumor moves price and a listing can drive volume. On the contrary, a sudden spike flips sentiment. The only constant is what the chart shows. And traders who learn to read it, who train their eyes, build structure, and respond with precision, move ahead.

Charting tools offer more than visuals. They offer confidence. They remove confusion. They build rhythm. At Visiion.io, we believe every trader should see their edge clearly.

The screen is your workspace. The candle is your signal. The chart is your strategy. Make every move count.

Trading with Visiion.io is powered by TradingView, bringing clarity, speed, and precision to every single click.