Crypto Regulation Updates of 2025: What Actually Happened This Year?

You probably felt it in 2025 already. Crypto no longer lives only in headlines and court cases. Rules now sit in statutes, rulebooks, licensing portals, and tax receipts. This year, the new crypto regulations turned regulatory noise into a traceable paper trail, and the impact shows up from ETFs in New York to stablecoins in…

How to Track Crypto Whale Movements During Holidays: A Beginner’s Playbook

Holiday stretches often feel slower, but anyone who has watched the crypto market long enough knows the surface calm rarely tells the entire story. Activity from large holders tends to stand out more, price reactions feel sharper, and the mood sometimes tilts with a single transfer. Analysts who study seasonal market behavior often mention that…

Top Mistakes to Avoid When Purchasing Cryptocurrency Online

Every crypto bull run brings a new wave of first-time buyers, people chasing opportunity, headlines, or curiosity. Yet with every rush, the same patterns repeat: lost keys, fake exchanges, and rushed trades. Analysts point out that most losses in crypto aren’t caused by bad luck or scams, but by basic Cryptocurrency Buying Mistakes made during…

What Is Aave (AAVE)?

When you talk about DeFi, a few names come up instantly: Uniswap, Curve, and one that practically shaped decentralized lending as we know it: Aave Crypto. It’s not hype. It’s history. Aave turned an idea, “borrowing without banks”, into a fully functional, multi-chain liquidity network that moves billions every day. Experts often call it the…

Ever heard traders talk about 10x gains on Bitcoin without owning a single coin?

That’s crypto derivatives trading. It’s fast-paced, complex, and central to how pros manage risk, speculate on price moves, and shape market liquidity, all without touching spot markets. While most beginners start with buying and holding, the real action often unfolds in derivatives. This guide dives deep into what drives it, crypto derivatives meaning is, how…

What Is the USA BTC Strategic Reserve and What Does It Means for BTC’s Future

In the past couple of years, BTC has become quite mainstream. The rising interest of institutions and, more importantly, some nations, has made BTC an interesting asset. And since President Trump was reflected, he has been a vocal supporter of cryptocurrencies as a whole. One of the most interesting things the US administration has been…

What is Stop Loss and How Pro Traders Use It?

In trading, the term “stoploss” refers to a predefined price point that automatically closes a position to limit potential downside. Traders set this point while placing an order or after opening a position. It acts as a trigger to exit when the asset price reaches a certain level. The keyword “what is stoploss” carries weight…

Will We Ever Have More Than 21 Million BTC?

Since the inception of Bitcoin, there has been one factor that has helped it stand out. And that factor is its 21 million cap. Now, those who don’t know, there is a cap on the number of BTC that can be minted. And that number is 21 million. It means that once the 21 million…

What Is HODLing and Why Some Investors Prefer It?

Where Did HODL Even Come From? It all started with a typo. In 2013, a Bitcoin forum user wrote “I AM HODLING” in a post filled with emotion and whiskey. He wasn’t selling his Bitcoin during a price crash, and he didn’t care about spelling. That word HODL caught fire. Since then, it’s grown into…

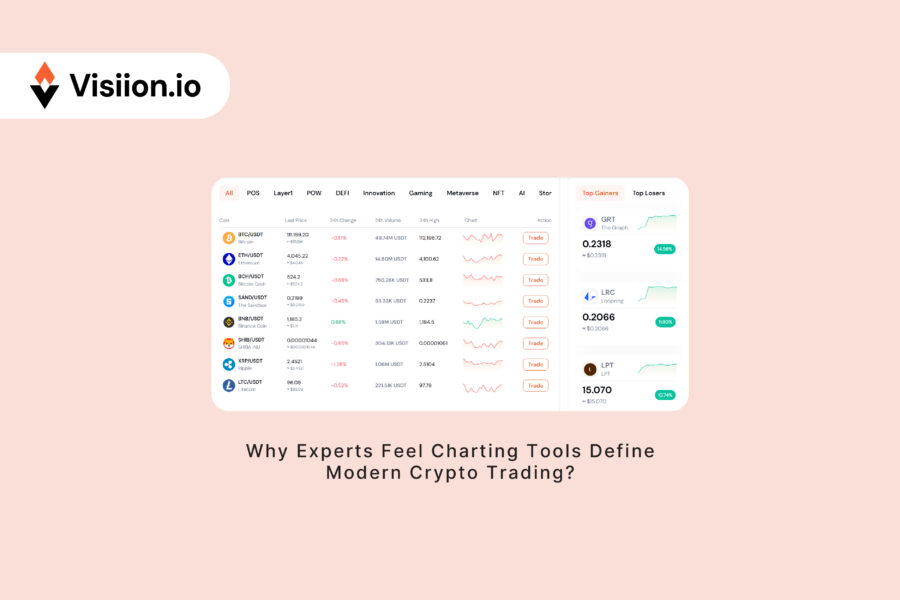

Why Experts Feel Charting Tools Define Modern Crypto Trading?

Crypto trading is built on speed, clarity, and precision. Visual cues drive decisions. Every candle speaks. Every spike, dip, and sideways grind carries a message. Traders today look at more than just numbers. They interpret behavior, energy, and momentum, all through the lens of charting tools. In this world, visuals shape trades. Tools translate chaos…