USDC vs USDT: Which is Better?

Stablecoins bring an entirely new angle to the crypto world. As the name suggest, they are comparatively stable as compared to other cryptos and tokens. Some of the most popular ones are USDC (USD coin) and USDT (Tether). Both of these coins are pegged against U.S. dollars. This makes them more stable in terms of pricing and valuation.

But if you are planning to invest in stablecoins and are confused between USDT vs. USDC, you have landed at the perfect place. In this blog, we will share a detailed comparison between both coins. Let’s get started.

USDC vs USDT: What’s the Difference?

Both of them are stablecoins. But they do have certain differences. These differences include:

Transparency and Regulation

USDC is a bit more transparent when it comes USDC vs USDT comparison. The reason is quite simple, it is more regulated as compared to USDT. USDC is issued by Circle. Circle works closely with regulators and provides monthly audits. Giant firms like Grant Thorton conduct these audits. These audits verify that each USDC token is backed by an equal amount of assets held in reserve. These reserves are usually in U.S. treasuries and cash deposits.

On the contrary, USDT (Tether) has always been a little less transparent. It is still battling multiple lawsuits as it has failed to provide regular audits. Tether claims that each USDT token is backed by 1:1 U.S. dollars. But the reserve reports are scant. USDT has been under legal scrutiny in the past. In fact, it was under scrutiny by the New York Attorney General’s Office itself! Although the case was settled, this might deter some investors from investing in it.

Adoption and Use Cases

As of today, USDT is the most widely used stablecoin globally. It has a market cap of over $ 117 billion! As it’s quite widespread, you will easily find its trading pairs on multiple exchanges, including Visiion.io, Coinbase, and Binance.

USDC has a far smaller market size, which is around #34.9 billion. Soi it’s obvious that it is not as popular as USDT. But still, it’s quickly becoming an eye-candy of certain investors. This is more common in the DeFi space. Some DeFi protocols like Compound, Aave, and MakerDAO often prefer USDC for collateral. Reason? Well, they prefer something more regulated and transparent!

Technical Infrastructure

Both USDC and USDT are blockchain-agnostic. This means, they can operate on multiple blockchain networks. It’s interesting to note that this is not the case even popular cryptos like BTC! USDT supports a wider variety of blockchains when compared to USDC. This includes Bitcoin (via the Omni Layer), Ethereum, Tron, Algorand, EOS, and others. So in terms of market acceptability, USDT wins.

USDC, on the other hand, was initially built on Ethereum. But today, it has expanded its presence to 16 blockchains. Some of the most popular blockchains where you can USDC are Avalanche, Solana, and Stellar.

Market Capitalization and Liquidity

USDT is the clear leader here. It has a market cap of over $117 billion in circulation. This is quite higher than that of USDC’s $34.9 billion. This massive liquidity makes USDT the preferred choice for traders and institutions. They often need large buyers and sellers to avoid slippage and liquidity issues.

But USDC is growing rapidly. It is becoming more and more popular. This is more common amongst institutional investors and those in the DeFi space.

What are the Benefits of Using USDC

USDC brings in quite a lot benefit with it. They include:

Transparency and Trust

USDC’s regular audits make it one of the most trustworthy stablecoins in the market. At the top, it’s well-regulated. This is a major benefit against other stablecoins. So, if you are looking for a coin that’s stable and reliable, USDC is a clear winner.

Stable Value

USDC maintains a stable 1:1 peg to the U.S. dollar. And this has been proven via regular audits. So, if you are looking for a safe haven during market volatility, USDC might be a good one. You can use it to hedge against swings in the crypto market.

Compatibility with Multiple Blockchains

USDC’s is present on 16 blockchain networks. This includes Solana and Avalanche. So, you get good options to use USDC, especially if you are into DApps.

Growing Adoption in DeFi

DeFi space is increasingly adopting USDC. The reason is its transparency and regulatory compliance. A lot of DeFi platforms prefer USDC as a collateral asset as it undergoes regular audits.

Risks of USDC

Just like other stablecoins, USDC also has some inherent risks associated with it. These risks include:

Dollar Inflation

USDC is pegged to the U.S. dollar. So it’s quite vulenerable to inflation. It’s value will decrease in sync with the U.S. Dollar.

Centralization

USDC is fully centralized, which means Circle and Coinbase have full control over its issuance. Now, that’s exactly against the core principle of cryptocurrencies! Regulating authorities can freeze stablecoins like USDC as and when they want to. So, it’s not a good decentralized alternative.

What are the Benefits of Using USDT

Now let’s take a look at the benefits of using USDT:

High Liquidity

USDT’s has a massive liquidity. This makes transactions on any major exchange easy. So, it’s a great choice for ultra HNIs, HNIs, and institutional investors who need a lot of liquidity to move large sums of money.

Widespread Adoption

USDT is accepted on nearly every cryptocurrency platform and exchange, making it the most accessible stablecoin in the market. Whether you’re trading, lending, or staking, USDT is likely to be supported.

Low Transaction Fees

Depending on the blockchain used, USDT transactions can be cheaper than those of USDC. For example, USDT on the Tron network offers fast and low-cost transactions.

Risks of USDT

USDT has its own set of limitations. These limitations include:

Transparency Issues

USDT has faced criticism for its lack of transparency. While Tether has made efforts to improve its auditing practices, it still lags behind USDC in terms of independent verification.

Legal Scrutiny

Tether has been involved in legal battles and regulatory issues. The most common notorious one was with the New York Attorney General. The reason was its reserve backing and transparency.

Alleged Price Manipulation

There have been allegations that Tether has been used to manipulate Bitcoin prices. While the claims are not verified, some users might feel concerned about investing in it.

USDC vs USDT Which is Better?

Now, the answer to this question depends a lot on what your focus is. If transparency is your only concern, USDC is a good investment option. But USDC strays away from the core concept of cryptocurrency a lot, which is decentralization. On the contrary, USDT brings in high liquidity, more acceptance, and higher decentralization.

USDT has a massive market cap of $117 billion. This makes trading easy, too, as the liquidity is quite high. So, if you look at the overall scenario, USDT might be a good option for you.

How to Buy USDT?

You can invest in USDT and other tokens via reliable platforms like Visiion.io. On Visiion.io, you can buy USDT with a few simple steps. Here’s how you can do it:

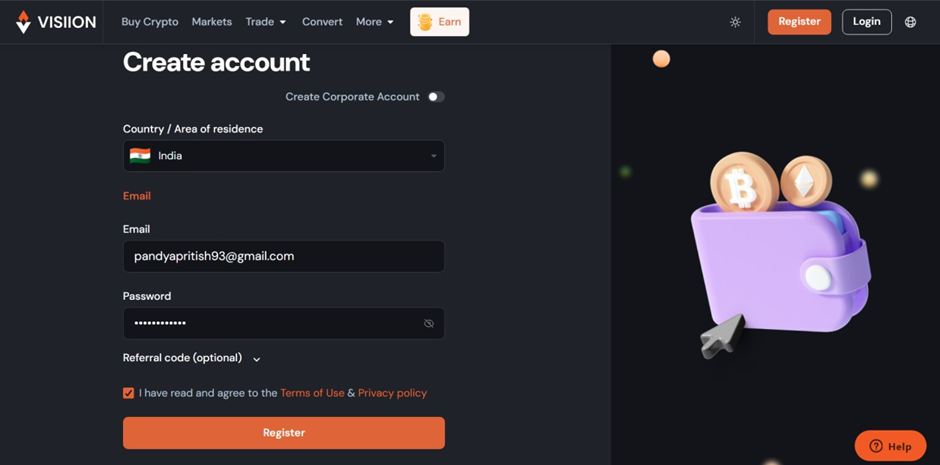

Sign up onVisiion:

Go to our website and create your account. Add a few necessary details, and you’ll have your account ready

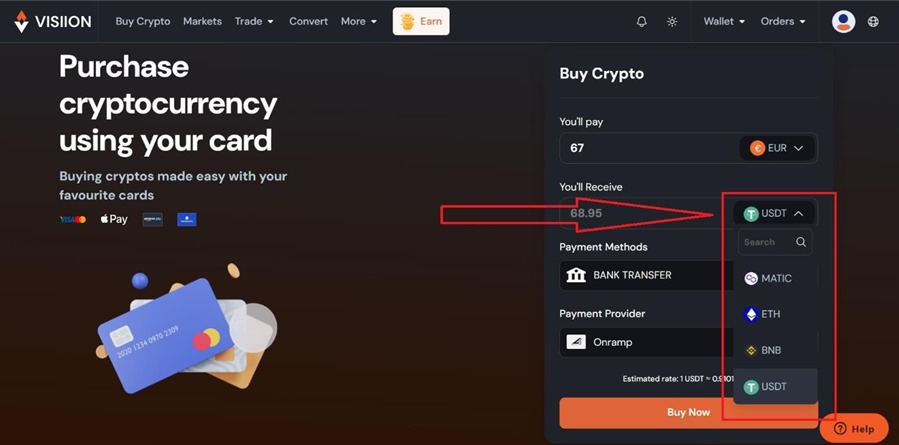

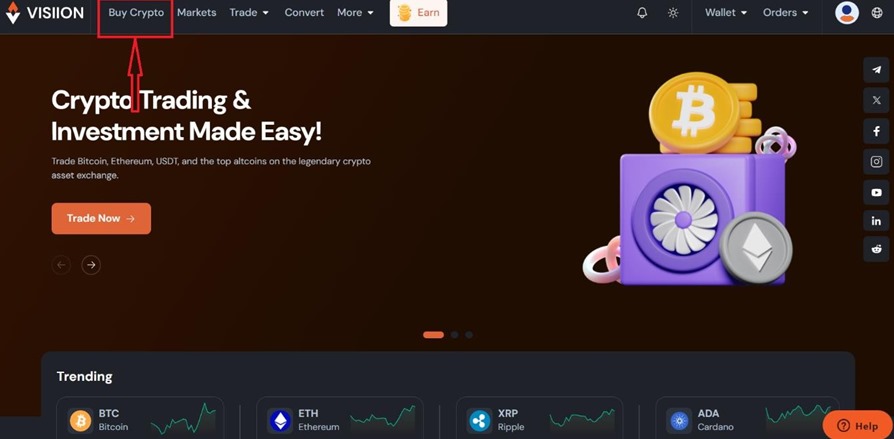

Got to Buy Crypto section:

Login to your Account and go to the “Buy Crypto” section. It will be on the top left bar. Click on that option

Buy USDT (SOL)

Now, you’ll see an option to buy crypto. Enter the amount in Euro, AED, or INR. Once done, select the USDT from the drop-down menu. The number of USDT will automatically adjust in relation to the amount you have entered. Pick your payment method and hit the “Buy Now” button. Complete the process, and USDT will be deposited directly into your account.