About Solana vs. Ethereum?

Blockchain is slowly but steadily penetrating in a lot of industries. With the unique concept of decentralization and added security, it’s obvious that blockchain-based apps are making rapid growth.

But did you know? There is more than one type of blockchain in the market. Two of the most popular ones include Ethereum and Solana. While Ethereum is quite popular and older than the other two, Solana is making its way to the top.

People often get confused between Solana and Ethereum. So here’s a quick comparison between them for you. Both blockchains offer investment options to the investor. So before investing, it’s important for investors to understand what exactly they are getting into. Without much adieu, let’s get started.

History and Use Cases of Ethereum

Ethereum was introduced in 2015 by Vitalik Buterin and his co-founders. Ethereum is often treated as the pioneer in smart contracts and decentralized apps (DApps). In fact, ETH, the Ethereum token, is the second largest token after Bitcoin by market cap. But it’s interesting to note that both are entirely different. Bitcoin is more like digital gold, which is purely an investment opportunity. On the contrary, Ethereum offers a powerful platform to build multiple decentralized solutions. That’s the reason why it has led to a rich ecosystem of decentralized finance (DeFi) projects, non-fungible tokens (NFTs), and other applications.

Ethereum’s smart contract functionality is the backbone of multiple innovations in the crypto industry. For example, popular DeFI protocols like Uniswap and MaketDAO are based on the Ethereum platform. On top of that, NFT platforms like OpenSea also work on the Ethereum blockchain. Moreover, Ethereum’s latest Proof of Stake (PoS) mechanism. It’s way more eco-friendly and efficient than its older Proof of Work mechanism.

History and Use Cases of Solana

Solana, founded by Anatoly Yakovenko in 2017. It brought a unique approach to the blockchain technology. It offers high throughput and low transaction costs. The core idea behind developing Solana was to tackle the scalability problem with other blockchains. Unlike other blockchains, it uses a Proof of History (PoH) consensus mechanism. This one is quite unique. It works alongside the PoS mechanism to validate transactions efficiently and quickly. And that’s how Solana processes thousands of transactions per second. This is a lot more than what Ethereum can process.

Solana’s ecosystem is younger than Ethereum. But it surely has made some big strides. Solana also supports an array of DeFi applications, NFT projects, and other decentralized projects. Some of the quite popular ones are Serum (a decentralized exchange) and Audius (a music streaming app)

Key Differences Between Solana and Ethereum

Consensus Mechanism

The basic difference between Ethereum and Solana is their consensus mechanism. Initially, Ethereum worked on traditional Proof of Work mechanisms like Bitcoin. However, it recently shifted to the Proof-of-Stake mechanism. Here, validators secure the network by staking their ETH. Result? The energy consumption comes down drastically.

But Solana utilizes the Proof of History mechanism. It’s a quite unique and new concept. Here, each transaction is timestamped. This results in a hyper-fast and efficient process. Result? Solana is a lot more scalable and efficient. Similarly, it can handle high transaction volumes.

Scalability and Transaction Speed

Scalability is a big problem with Ethereum. As of now, it can process 15 to 30 transactions per second. But Solana is way faster than this one. It can perform 65,000 transactions per second! Its Proof of History or PoH consensus mechanism makes it the fastest blockchain in the market. Imagine the volume of transactions it can perform!

Transaction Costs

High gas fees have been a longstanding issue on Ethereum. Its impact falls on the end users and developers. This makes the transactions on Ethereum too costly. These fees fluctuate based on the network demand. Sometimes, it becomes so exorbitant that not all can afford it. On the contrary, Solana offers a more predictable and low-cost fee structure. Result? Transactions cost just a fraction of a cent. So, in terms of Solana fees vs Ethereum fees, Solana is a lot more cost-effective. So, Solana could be a cost-effective option for developers.

Development and Community Support

Community support is critical for the success of any blockchain. The same goes for Ethereum and Solana. Here, Ethereum clearly outranks the Solana. Ethereum has a first-move advantage as it came early. It has a wide range of development tools and a robust ecosystem. While Solana is becoming popular, it does not enjoy such massive community support right now.

Things to Consider While Investing in Ethereum Vs. Solana

Market Performance and Trends

As of now, Ethereum continues to dominate as a blue-chip asset in the crypto space. As it’s old and quite popular, traditional investors are still sticking to it. As of now, it has a $200 billion market cap.

The reason for such a massive market cap is the wide utility of its extensive ecosystem of

decentralized applications (DApps) and smart contracts. Today, it’s the go-to platform for major DeFi protocols like Uniswap and Compound, as well as NFT giants like OpenSea. Such a broad adoption makes it a comparatively safer bet, albeit with low return potential, according to some experts. Ethereum has been trading between the range of $1,500 to $2,500.

On the contrary, Solana has a smaller market cap. With $20 billion, its market cap is almost 10th of the Ethereum. But Solana has carved out a niche for itself with its hyper-fast transaction speed. This is reflected pretty clearly in the valuation of the SOL token. It surged almost 250% in the year 2023. Moreover, the rise in the adoption of DeFi and NFTs has given rise to investors’ sentiments. The only issue? Its price has fluctuated a lot between $15 to $35 in the year 2024. But given its technical edge over Ethereum, some investors believe SOL can be a good investment opportunity going forward.

Potential Risks and Challenges

If you are planning to invest in any of these tokens, it’s important to know about the challenges, too. Ethereum struggles with scalability. Moreover, the transaction fees might go up to $50 at peak times. This can prevent the developers from using it widely. This might be visible in the subdued ETH price.

Solana, too, has some risks related to it. There have been multiple instances where Solana faced multiple outages. Additionally, Solana’s validator network is significantly smaller than Ethereum’s, which could lead to centralization risks. This poses a potential vulnerability to network attacks or governance issues.

Growth Potential and Future Outlook

The challenges exist for both the blockchains. But as they are bringing in innovative solutions, they can surely offer good investment options. Ethereum recently released its ETF, too. While ETFs’

principle contradicts the core principle of the cryptocurrency, it might push ETH’s prices higher, according to experts.

Similarly, Solana is rapidly being adopted as the mainstay for multiple decentralized applications. Moreover, as the market cap of SOL is comparatively small, the chances of an increase in its valuation are higher. So, is Solana better than Ethereum? Well, certain experts believe so. They feel that Solana is more efficient and advanced technology. So, in Ethereum vs SOL, the SOL offers a good investment opportunity. But that’s just their opinion. For investors, it’s very important to analyze the existing marketing trends before investing in any asset.

How to Invest in Solana?

You can invest in SOL and other tokens via reliable platforms like Visiion.io. On Visiion.io, we havesimplified the Solana investment a lot. You can buy SOL with a few simple steps. Here’s how you can do it:

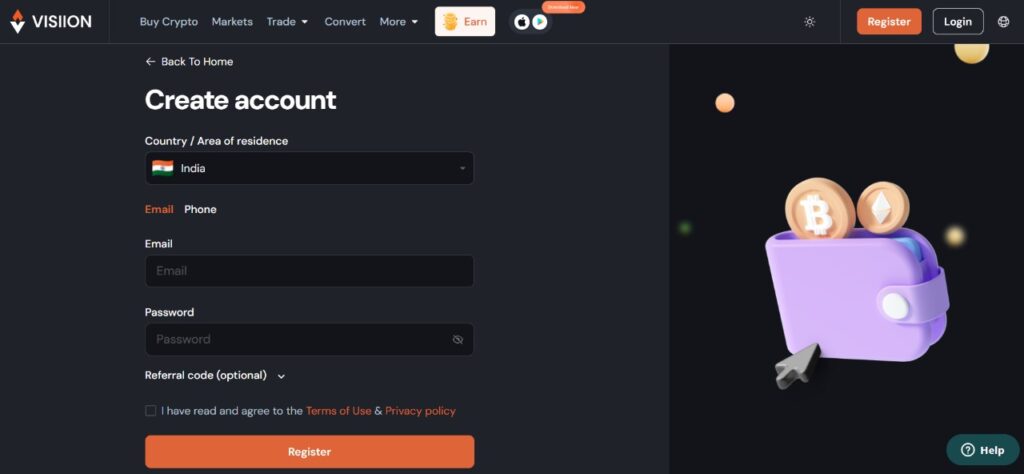

Step #1: Sign up on Visiion:

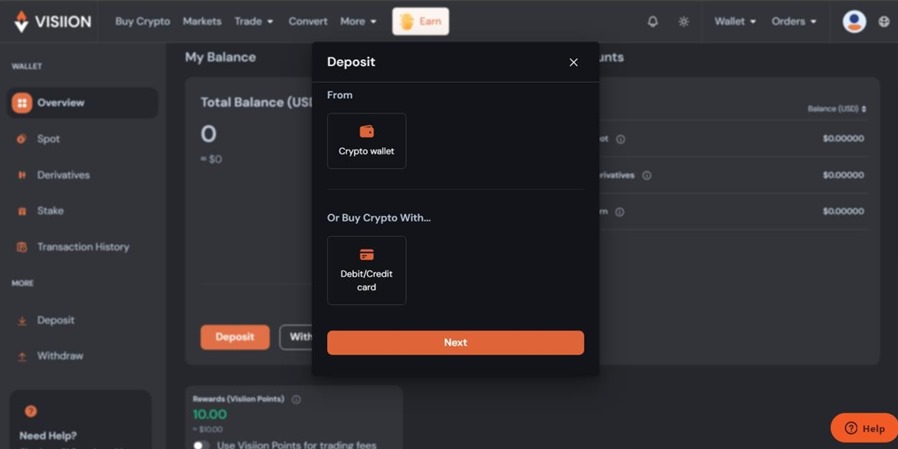

Step #2: Deposit Funds

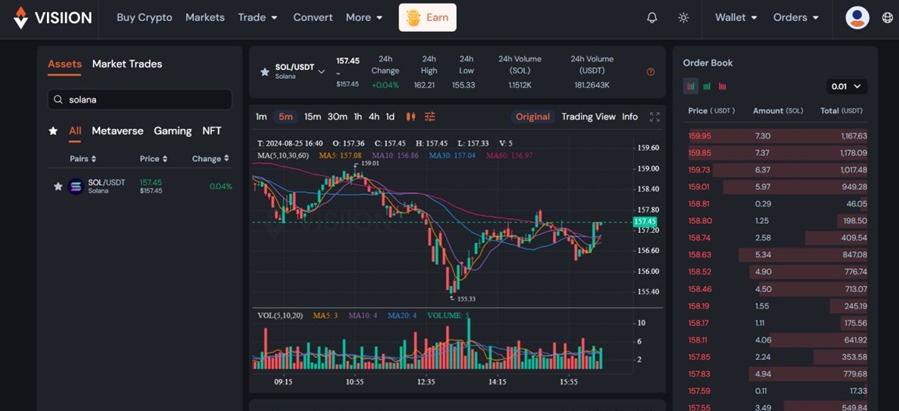

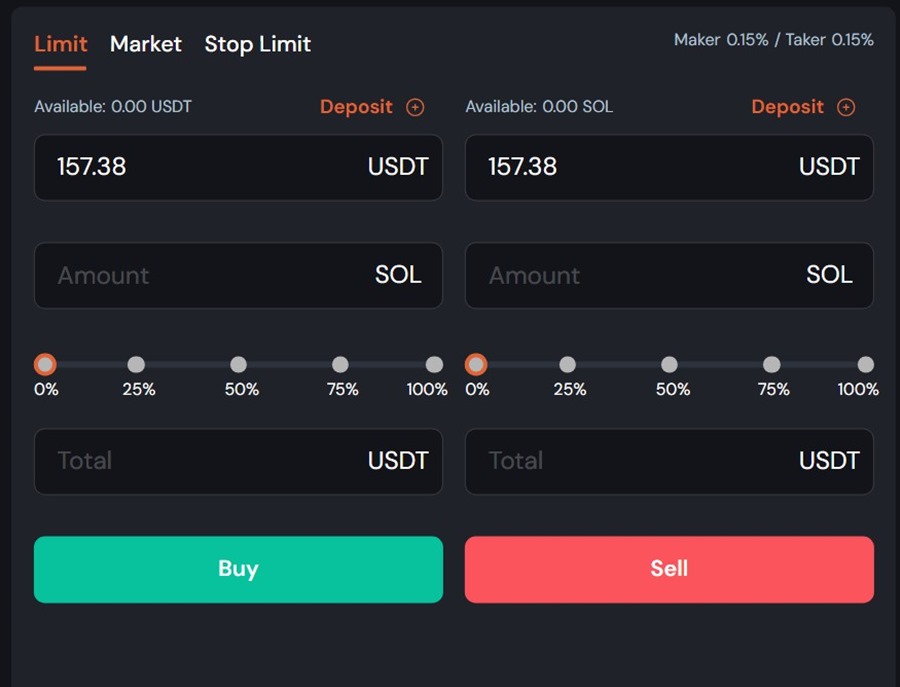

Step #3: Buy Solana (SOL)

Here, you will find multiple order types here. You can pick anyone up at your convenience. Add the exact information on

how many SOLs you want to buy and the buying price, and click “Buy,” and you will get your SOL in your Account.

Final Thoughts

Sol and ETH both offer good investment opportunities, according to a lot of market experts. Solana and Ethereum are bringing some really interesting innovations to the market. And as the world is slowly moving towards blockchain and decentralization, opportunities are immense. Ethereum’s rich ecosystem and established position make it a strong contender for long-term investments. Similarly, Solana’s speed and efficiency offer an exciting investment alternative.

But the only thing investors have to take care about is, picking the right investment platform. Remember, reliability, speed, and security are the top qualities that a crypto exchange must have. So, as an investor, always pick a platform that offers you a perfect combination of all these three. When we designed Visiion.io, that was precisely our goal. So, if you are planning to invest in SOL, ETH, or any other crypto, feel free to explore our platform. You will enjoy its simplified UI, military-grade security, and efficacy.