Ethereum vs. Ethereum Classic: Who Wins?

If anyone had to name the top 3 cryptos in the market, Ethereum(ETH) would surely be in the top 3. It has become almost as popular as Bitcoin, if not more. But do you know there is another Ethereum crypto, too? It’s known as Ethereum Classic(ETC) and is as old as the more popular Ethereum.

So, how has this Ethereum vs Ethereum Classic battle begun? How are both different and why? It’s time to find out!

Ethereum and the DAO Hack

Vitalik Buterian came up with Ethereum in 2015. He launched Ethereum as a decentralized platform where developers can build smart contracts and dApps (Decentralized Applications.)

Ethereum had one amazing feature, it eliminated the need of intermediaries. Instead, it offered a programmable blockchain. Each contract will be executed autonomously on this Blockchain. This was a watershed moment for the blockchain industry. The developers started flocking around Ethereum to build an array of decentralized projects. These projects included games, DeFi (Decentralized Finance), and a lot more.

A Disruption That Changed Everything

Ethereum was working smoothly, developers were happy, and participants were happy. But then, a major disruption struck Ethereum in 2016. When Ethereum was booming in popularity, the DAO came into existence. DAO, or Decentralized Autonomous Organization, was an investor-directed venture capital fund. It ran on Ethereum’s Blockchain.

But in 2016, a hacker identified a vulnerability in its code. They used this vulnerability to siphon 3.6 million Ether, valued @ $50 Million! Now this was no small amount and obviously caused a massive uproar amongst the investor.

Interestingly, two groups emerged after this cyber-attack on the Ethereum blockchain. One group wanted to reverse the Blockchain and recover the stolen funds. But this would impact Blockchain’s immutability. The other group wanted to keep Ethereum as it is and maintain its history untouched. This would prevent the recovery of the lost funds but would maintain the immutability of the Blockchain itself.

This debate ultimately resulted in a hard fork in July 2016. A large majority of the Ethereum community decided to reverse the hack. This helped them recover the stolen Ether. But this created a new chain called Ethereum (ETH.) The smaller faction that opposed this reversal kept working on the original Blockchain. This original Blockchain has an apt name, Ethereum Classic (ETC).

Now, the question is, how do these two blockchains differ from each other? What are the technicalities? And most importantly, how should an investor act? Let’s first see the difference between Ethereum and Ethereum Classic

Ethereum vs Ethereum Classic

Consensus Mechanisms

Initially, Ethereum and Ethereum Classic both operated on Proof of Work (PoW) mechanisms to validate transactions and secure the system. But Ethereum shifted to a Proof of Stake (PoS) mechanism with the introduction of Ethereum 2.0. Now, this was a seismic shift for the entire blockchain industry. Proof of Stake consensus uses a lot less energy and hence is more eco-friendly. On the top, it’s far more scalable than its predecessor. On the contrary, Ethereum Classic still uses the Proof of Work consensus mechanism as it is striking to its original decentralized ethos. So, we can say that Ethereum’s ecosystem is more diverse and has wider applications.

Blockchain Protocols and Upgrades

Ethereum keeps coming up with new updates in its Blockchain. They do so to stay ahead in the competition. Remember, Ethereum is all about scalability, security and user experience. So they bring in everything possible update that enhances these three qualities.

On the contrary, Ethereum Classic is solely focused on maintaining its originality. So, it’s quite slower in adopting new changes and releases updates less frequently. Overall, the solutions for Ethereum 2.0 and Layer 2 are too robust and powerful compared to those of Ethereum Classic.

Smart Contract and DApp Support

There is no competition here. Ethereum easily dominates the decentralized application industry. There are thousands of DApps that use Ethereum Blockchain. Some of the most popular ones include Uniswap, Aave, and OpenSea.

While Ethereum Classic also supports smart contracts and DApps, its ecosystem is quite small. Result? Very few developers use it to build apps.

Use Cases and Applications

Ethereum’s Use Cases

Ethereum is all about wider applications. It’s a multi-purpose platform. It has massive applications, especially in the field of DeFi, NFTs, and enterprise solutions. As more people are turning towards these products, Ethereum is witnessing massive demand. For example, the DeFi sector allows users to lend, borrow, and trade without traditional banks. Similarly, people use NFTs for digital ownership of unique assets. All this is possible with the Ethereum blockchain. Ethereum’s flexibility makes it attractive for developers looking to build innovative applications.

Ethereum Classic’s Use Cases

Ethereum Classic is still focused on its original vision. ETC’s primary appeal lies in its commitment to immutability and its adherence to PoW. This makes it very popular in the blockchain purists.

Security Challenges

This is another forte of Ethereum. It has a very robust infrastructure to protect itself and its investors against cyber-attacks. On the contrary, cyber-attacks like 51% attacks are quite common on Ethereum classic. That’s why a lot of institutional investors think twice before investing in Ethereum Classic. This robust security makes Ethereum a very popular contender amongst the two for investments.

Mitigation Measures

Ethereum Classic has strong security measures too, just like Ethereum. But still, Ethereum’s pro-active approach gives it a strong edge.

Market Performance of Ethereum vs Ethereum Classic

Ethereum (ETH) continues to dominate the market as the second-largest cryptocurrency, only trailing Bitcoin. Today, Ethereum’s market cap is around $239.4 Billion. In fact, the daily trading volume is almost $15 Billion! Result? There is a lot of liquidity for Ethereum in the market. This can be a great sign for the investors and traders. Remember, liquidity is key while trading any asset, including cryptos. You must have a buyer or seller to fullfiill your orders, right?

Ethereum Classic (ETC) too has a good market cap of $2.6 Billion, but it’s nowhere near to that of ETH. Moreover, the trading volume fluctuates between $100 million and $250 million. While ETC maintains its relevance, it is far more volatile than ETH and lacks the same depth of liquidity.

Adoption and Popularity

Ethereum enjoys widespread adoption across industries. It is the backbone of decentralized finance (DeFi), non-fungible tokens (NFTs), and enterprise blockchain applications. Major institutions like JPMorgan and Microsoft are among the many that utilize Ethereum’s smart contract capabilities. With thousands of decentralized applications (DApps) built on it, Ethereum has positioned itself as the go-to platform for innovation in Web3.

In contrast, Ethereum Classic lags behind in terms of developer support and enterprise adoption. Its focus on maintaining immutability appeals to blockchain purists, but it hasn’t garnered the same attention from developers or businesses. ETC’s ecosystem is smaller, and most view it as a niche or speculative platform rather than one driving future technological advancements(

While both platforms offer value, Ethereum’s sheer scale and ongoing innovations, such as Ethereum 2.0 and Layer 2 solutions, make it the preferred choice for the majority of users and developers.

Future Outlook

Ethereum

Ethereum’s future is exciting, with ongoing upgrades like sharding and Layer 2 solutions to improve scalability. The ecosystem is also pushing further into areas like decentralized finance (DeFi), NFTs, and the metaverse, making Ethereum a critical player in the Web3 revolution

Ethereum Classic

Ethereum Classic is less ambitious in its development. It remains focused on maintaining its original vision of decentralization and immutability. While there are efforts to improve its security and scalability, it lacks the large-scale support and adoption that Ethereum enjoys.

How to Invest in Ethereum?

You can invest in SOL and other tokens via reliable platforms like Visiion.io. On Visiion.io, we have simplified the Solana investment a lot. You can buy SOL with a few simple steps. Here’s how you can do it:

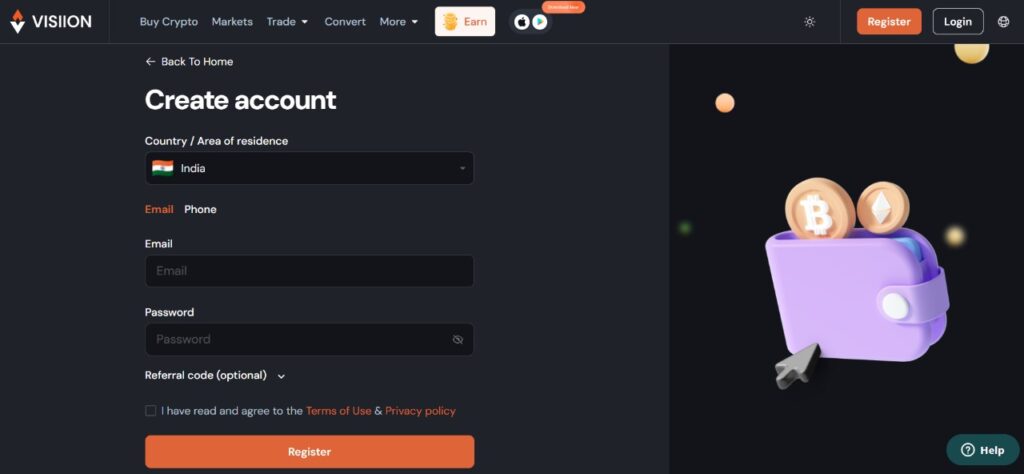

Sign up on Visiion.io:-

Visit our website and create your account. Add few necessary details and you are good to go.

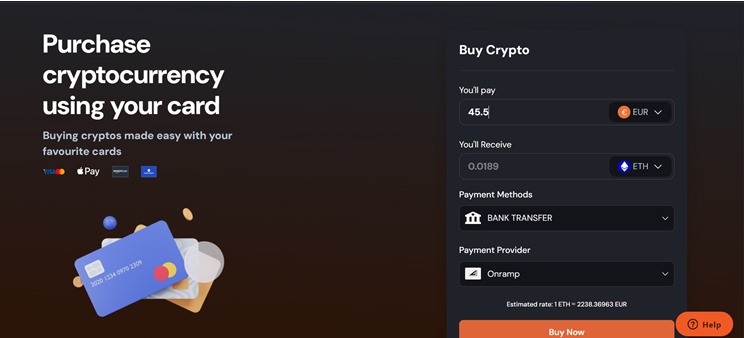

Buy Ethereum (ETH)

Now go to the “Buy Crypto” option available on a task bar located at the top left. Here, click on “Buy Crypto” and you will land on the page that looks something like this: Add how much worth of ETH you want to buy, pick currency, and select the ETH from the drop-down menu. You can also change the Payment Method and Payment Provider. Add all the necessary information and hit “Buy Now.” See? It just takes few simple clicks to buy ETH from Visiion.io. You can explore multiple different currencies too on our boutique crypto exchange.

Invest With Care

Ethereum Classic is the original and old Ethereum out there. But to be honest, things have to keep adapting and changing with time. Same had to be done with old Ethereum. Today, Ethereum 2.0 is literally transforming the blockchain industry. Whether it’s NFTs or DeFi projects, Ethereum has become a go-to platform for the developers.

So as an investor, Ethereum (ETH) surely offers more balanced and reliable investment and trading options. But Ethereum Classic (ETC) too is not going away anytime soon. So, investors should weigh in both the assets, analyze their investment goals and make the right choice.